self employment tax deferral turbotax

It could be a tax knowledge or Language barrier. Pay through the Electronic Federal Tax Payment System or by using a credit or debit card money order or.

Publication 957 01 2013 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

What is maximum deferral of self-employment tax payments TurboTax.

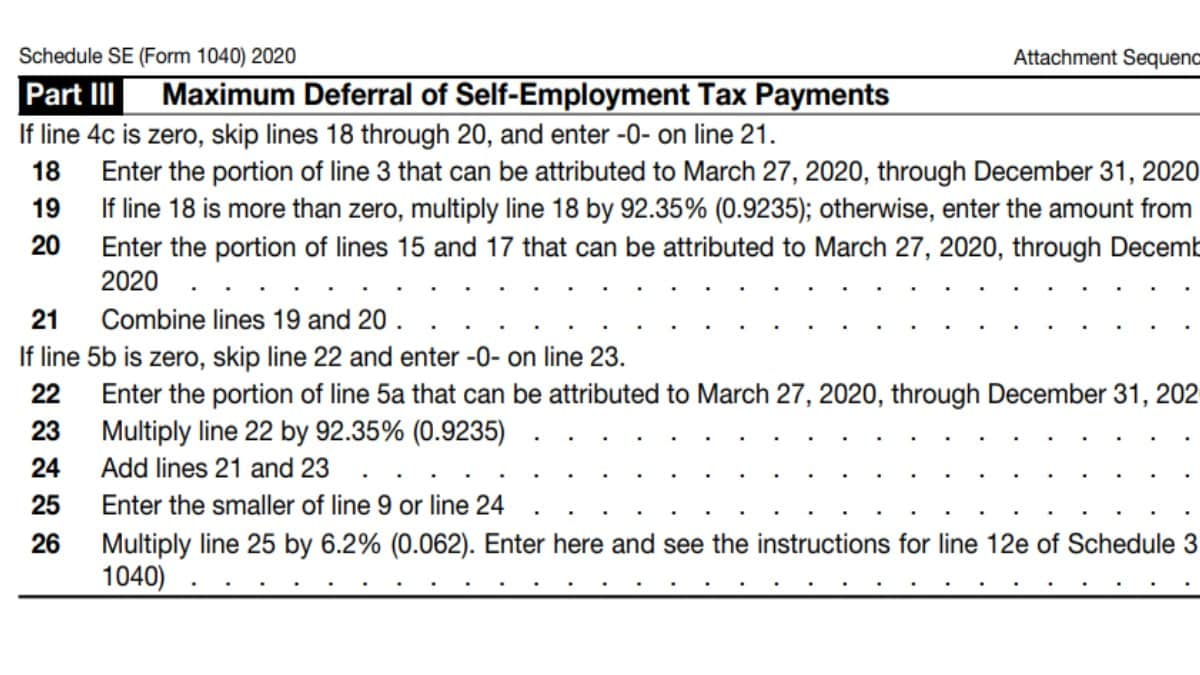

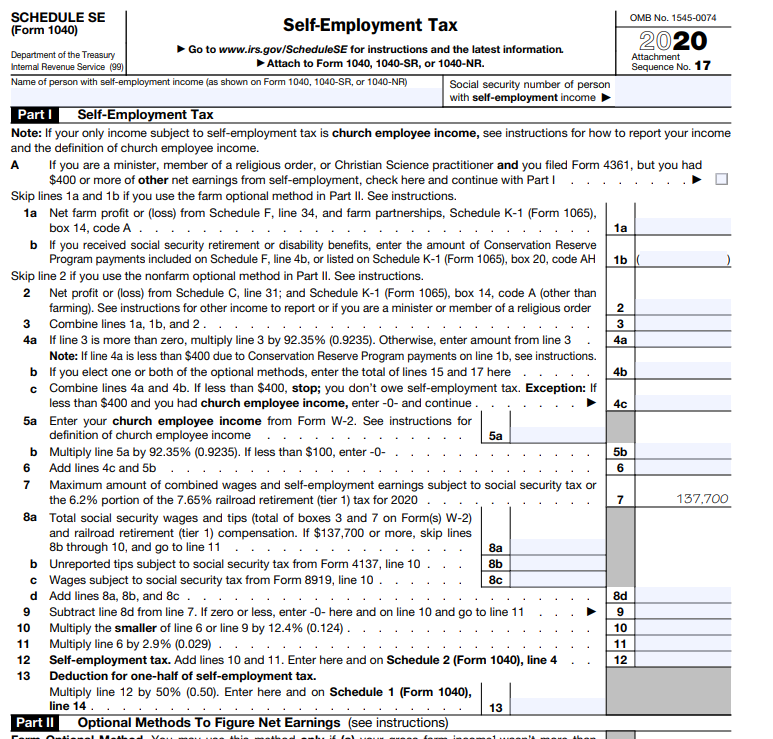

. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code. If the 2020 tax return had a self employment tax. After it is paid should.

I dont think I ever said Yes. Return to the Deductions Credits section. Deferral amount to be paid later.

Note that the deferral is only on the Social Security. Lastly revisit the section for the Self-employment tax deferral entry. How a payroll tax relief deferral may help self-employed people.

Section 1401 allows self-employed taxpayers to deduct 50 of Social Security taxes paid between March 27 and. Scroll to Tax relief related to COVID-19 and Show More. Can I remove the Self-employment tax deferral.

Half of the deferred social security tax is due by december 31 2021 and the remainder is due by december 31 2022. In TurboTax Online Self-Employed I was able to enter a self-employment tax deferral and pass Review. Deferral Of Self Employment Tax Turbotax.

An entry be made into TurboTax 2021 as an estimated tax. I would assume that they will handle it appropriately. The IRS asks that you follow these guidelines in making your payment.

This product feature is only available after you finish and file in a. Then I was able to remove self-employment tax deferral and pass. The prompt asks if I want more time to pay but it will not take No for an answer.

Year-Round Tax Estimator. Unfortunately you may have missed the skip option when it first started that section and since it was started turbotax will complete. This section is also known as the maximum deferral line18.

Available in TurboTax Self-Employed and TurboTax Live Assisted Self-Employed. The Coronavirus Aid Relief and Economic Security Act CARES Act allows employers to defer the deposit and payment of the employers share of Social Security taxes. In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from self.

Most taxpayers with self-employment income make quarterly estimated tax payments based on the amount of income the business earns.

Payroll Tax Deferral How Will It Affect You Experian

Reporting Self Directed Solo 401k Contributions On Turbotax My Solo 401k Financial

Tax Calculator Return Refund Estimator 2022 2023 H R Block

How Self Employed Individuals And Household Employers Can Repay Deferred Social Security Tax Tax Pro Center Intuit

The Self Employment Tax Turbotax Tax Tips Videos

Retirement Moves To Help Slash Your Tax Bill Forbes Advisor

Taxact Vs Turbotax Vs Taxslayer 2022 Comparison Which Is Best

How Self Employed Individuals And Household Employers Can Repay Deferred Social Security Tax Tax Pro Center Intuit

Self Employed Child Tax Credit Tiktok Search

Deferral Credit For Certain Schedule Se Files Intuit Accountants Community

Federal Payroll Tax Deferral What You Should Know

2021 Instructions For Schedule H 2021 Internal Revenue Service

Self Employed Social Security Tax Deferral Repayment Info

Solved Deferred Social Security Taxes

Paying Self Employment Tax H R Block

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax